What Foreign Investors Need to Know About the Goods and Service Tax Malaysia

You’re looking to expand your business into Malaysia. The numbers are lined up, your pricing strategy is ready, and then you learn: Malaysia no longer uses goods and service tax. Suddenly, questions arise- what does this mean for your costs and compliance?

Well, for foreign investors, understanding Malaysia’s tax system is essential to avoid unexpected hurdles. In this guide, we’ll break down what GST once meant in Malaysia, what system has replaced it, how it operates today, and the key points you need to prepare for a smooth entry.

What Is GST?

GST stands for Goods and Services Tax. It’s an indirect tax levied on the supply of goods and services at each stage in the production and distribution chain. It includes crediting (input tax) mechanisms to avoid “tax on tax.” Many countries use GST or a variant called VAT to generate government revenue while maintaining neutrality across industries.

GST broadens the tax base (consumers of goods & services) for the country. It also reduces reliance on narrow taxes (like duties or excises), and creates a more transparent tax structure.

Does Malaysia Still Have GST?

No. The Truth is that Malaysia no longer imposes GST.

While the country had introduced the GST in 2015, following a change in government and widespread public concern over rising living costs, the Malaysian government reduced GST to 0% from 1 June 2018.

The GST regime was formally repealed and replaced with a new tax system: Sales and Services Tax (SST). So, for all practical purposes today, GST is history in Malaysia. Still, you may find legacy references to it in older contracts or tax discussions.

Malaysia’s GST Alternative: the Sales and Services Tax (SST)

SST is the current indirect tax regime used in Malaysia. It’s composed of two separate taxes:

Sales Tax: Levied on taxable goods (either manufactured domestically or imported).

Service Tax: Levied on specific, prescribed services provided by businesses.

The Malaysian Royal Customs Department (Jabatan Kastam Diraja Malaysia, RMCD) administers SST. Unlike GST, there is no input tax credit system. Businesses generally cannot deduct SST paid on inputs against SST collected on sales.

SST is intended to be simpler in terms of compliance than GST, but it also has limitations in coverage, as it applies only to prescribed goods or services.

How Sales and Services Tax Differs from Goods and Service Tax Malaysia

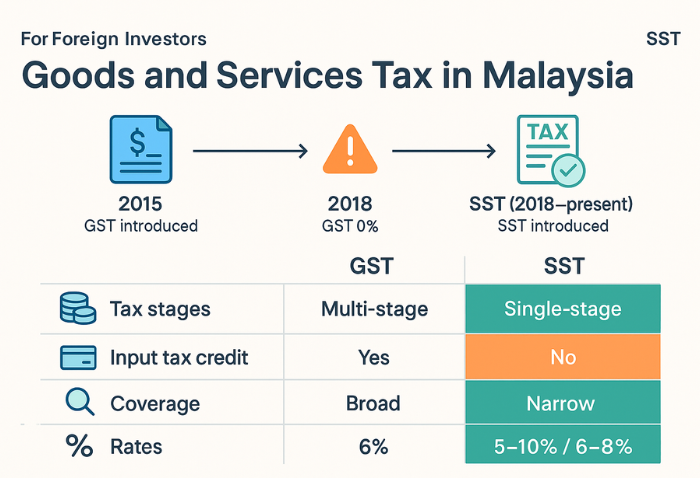

The table shows the key differences between the Sales and Services Tax and the GST:

| Feature | GST (old Malaysian system) | SST (current system) |

|---|---|---|

| Tax stages | Multi-stage (each supply along the chain) | Single-stage (only at the manufacturer/importer for goods, or service provider level) |

| Input tax credit | Yes. Businesses could claim credits on input GST. | No. The SST paid on inputs can’t be offset. |

| Coverage breadth | Very broad (almost all goods & services except exemptions) | Narrower. Only pre-designated goods/services fall under SST |

| Rate structure | Flat or structured with exemptions (6% standard) | Tiered. Goods taxed at 5% or 10%, services at 8% or 6% depending on sector (post-2024 reform) |

| Exports treatment | Zero-rated (so exporters don’t pay) | Goods for export generally exempt; services may vary depending on policy |

| Compliance complexity | Higher, more frequent returns, and credit tracking | Simpler, fewer stages, but extra care needed about classification and thresholds |

Because SST is more limited, many businesses find they must carefully map which of their goods or services are “taxable” under SST and which are out of scope.

How Much Is Sales and Services Tax in Malaysia?

Rates for SST vary depending on the nature of the good or service being sold. Furthermore, several reforms have recently been introduced:

Sales Tax Rates: Usually 5% or 10%, depending on the category of the goods (essential goods are often exempt or at a lower rate).

Service Tax Rates: As of 1 March 2024, for most taxable services, the rate was raised from 6% to 8%.

Some services (food & beverage, logistics, telecommunications, parking) remain taxed at 6% under special treatment. Moreover, under Budget 2025, the Malaysian government announced an expansion of the SST, effective 1 July 2025, to bring more goods and services into the SST net (e.g., leasing, construction, financial services, healthcare, education, and beauty services).

The sales tax rates (5% or 10%) remain unchanged for non-essential goods, while essential goods remain exempt. Keep in mind that exemptions and zero-rated classes exist (e.g., staple foods, medicines, books), so not everything is taxed.

How Businesses Should Prepare for SST

For businesses who are entering the market, you should prepare beforehand so can avoid any potential hurdles due to SST being a little different from the GST:

Map your goods & services to SST schedules

One of the first things to do wihle starting a business in Malaysia is determining which of your product lines or service offerings fall under “taxable goods” or “taxable services.” Those not listed are out of scope.

Review and adjust your accounting / ERP systems

Since SST has no input tax credit, your accounting or ERP systems should separately account for SST collected and no mechanism to offset. Thus, you’ll have to ensure that the classification and reporting logic is updated.

Analyse your margins carefully

Without input credits, your cost base might increase. You may need to revisit pricing to ensure profitability or absorb some costs.

Monitor recent reforms

With the July 2025 expansion, services or goods previously exempt have become taxable. If you haven’t already, it might also help to review your products and service contracts to see if you have any new obligations.

Register timely

For sales tax, manufacturers whose taxable goods turnover exceeds RM 500,000 in any 12 months must register. Similarly, for service tax, businesses whose taxable service revenue exceeds RM 500,000 (or different thresholds for special sectors) are required to register.

Update contracts and pricing terms

In existing contracts that span multiple tax periods, include clauses regarding the applicability of SST, invoicing rules, and transition provisions.

Educate your team & clients

Since SST is less familiar to many, train sales, accounting, and procurement teams. Also, explain to your clients/customers how the tax affects pricing transparency.

Will GST Ever Return to Malaysia?

In August 2024, Malaysia’s government publicly stated that there were no discussions about reintroducing GST, despite speculation that a broad-based consumption tax might help shore up revenue.

Meanwhile, the current focus is on expanding SST’s base, tightening coverage, and improving compliance. Therefore, for the foreseeable future, businesses should plan for the evolution of SST, rather than a return to GST.

Conclusion

While the Goods and Service Tax Malaysia doesn’t exist, the country still has the SST. Additionally, since the scope is narrower, businesses must verify whether they need to pay the SST. Especially for foreign companies or those starting a business for the first time, it’s highly recommended to work with a taxation consultant in Malaysia.